Car Accident Lawyer Daytona Beach

Support You Deserve, Justice You Need

- Free Initial Review for Accident Cases

- We Can Come to You at Home or in the Hospital After Your Car Accident

- Proven Success Against Insurance Companies

Chanfrau Fights for Car Accident Victims

“When a client hires me to handle their auto accident case, they can be confident that they are getting an experienced lawyer that knows what he's doing.”

William Chanfrau, Jr.

Why having a lawyer is important

Defending Against

Lowball Settlement Offers

Often, an insurance company will offer settlements that are much lower than you actually deserve. We can review your offer and negotiate on your behalf, ensuring you receive the level of compensation you need.

Providing Aggressive

and Tireless Representation

In some cases, an injury lawsuit is the only way to collect the compensation that you are truly owed. Our car accident attorneys can deal with all aspects of your car accident case and represent you in court.

Ensuring You Will Be

Treated Fairly with Care

Our car accident lawyers have an advanced understanding of Florida's laws. Without an attorney, you run the risk of receiving a low settlement from an insurance company that falls short of what you deserve.

Founded in 1976

Client Satisfaction

Is at the Heart of What We Do

Kelly

Chanfrau

A “Best Lawyer in America”

Labor Law (2016-present)

Top 50 Female Attorney in Florida

Florida Super Lawyers

Lawyer of the year for 2021 & 2023

William M.

Chanfrau, Jr.

An “America’s Top 100 Attorney”

Selected as Best Attorney

Rue Rating's Best Attorneys of America

Rated at Highest Level of Professional Excellence

by Martindale-Hubbell AV

Expertise & Candid Support for Your Case

“I called Chanfrau & Chanfrau from the accident scene ... That was a smart call. Bill Chanfrau and his staff did a wonderful job...”

Ed

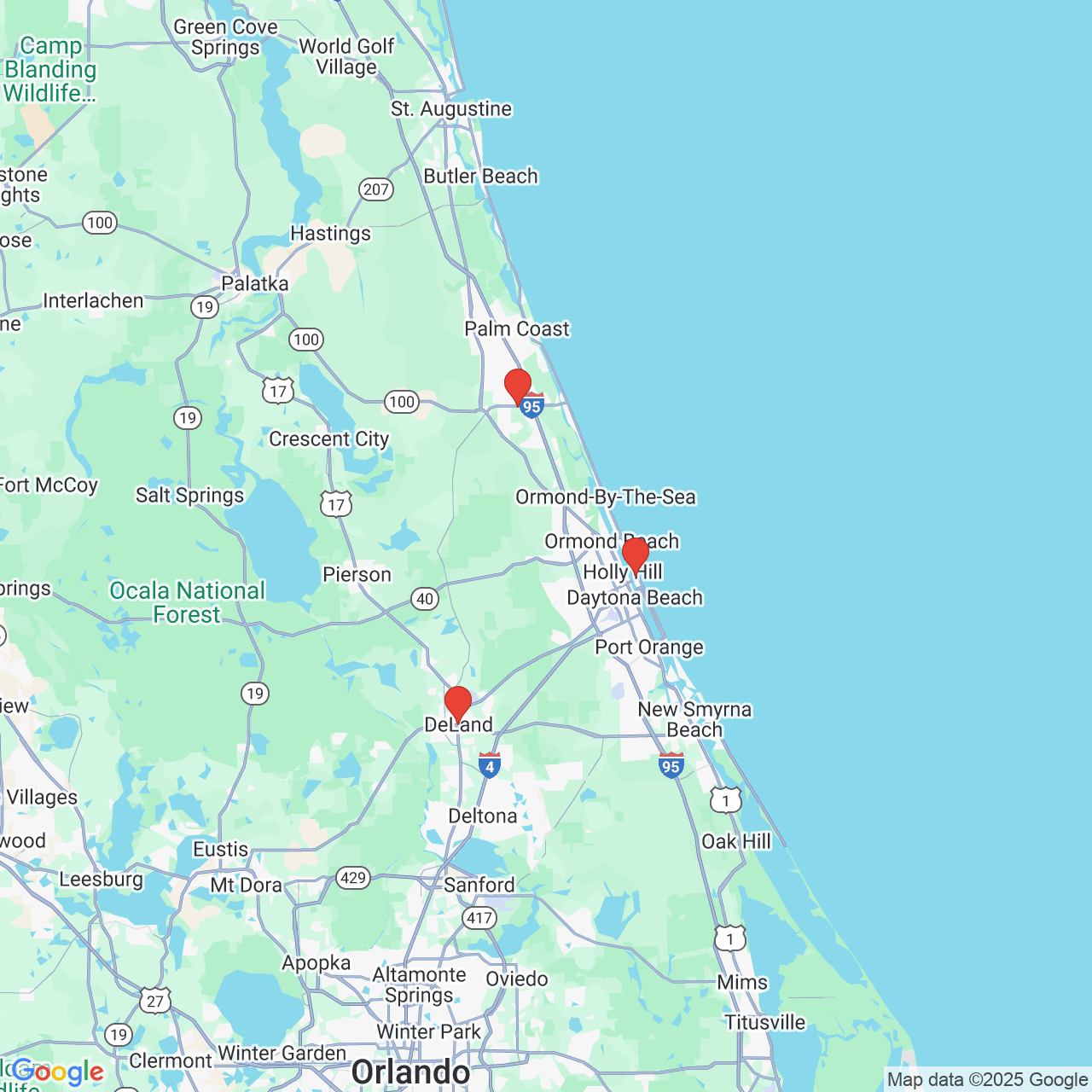

Central Florida Trusts Chanfrau

Dedicated Representation

and Resources

At Chanfrau & Chanfrau, we pride ourselves on being large enough to serve you professionally, yet small enough to know you personally. We have all the necessary resources to fully investigate your claim so that you do not settle for a dime less than you deserve.

Experienced and

Distinguished Attorneys

Our attorneys bring decades of expertise and a reputation for excellence, securing over $1 billion for clients. Kelly, "Lawyer of the Year," is Board Certified in Labor and Employment Law. Bill Jr. is an "America's Top 100 Attorney" with the highest Martindale-Hubbell rating. Bill Sr., Board Certified since 1983, helped establish a legal clinic for underserved communities.

Compassionate,

Personalized Legal Support

At Chanfrau & Chanfrau, we’re here to guide you through the challenges after an accident. If you can’t visit us, we’ll come to you for a free, no-obligation case review. With over 40 years of experience, our personal injury attorneys take a personalized approach, crafting legal strategies tailored to your case for the best possible outcome.

We Fight for You — and We Have the Results to Prove It

“Bill was the right person to get in touch with. I had never done anything quite like this before. I'm really pleased with the end result... Thank you, Bill”

“After many visits with doctors, procedures, medications, therapies, two surgeries, I've had no out-of-pocket medical expenses. They're amazing at what they do.”

“ I called Chanfrau & Chanfrau from the accident scene .... That was a smart call. I ended up working with Bill Chanfrau and his staff, who did a wonderful job.”

Justice & Compassion When It Matters Most

- Free First Consultation

- Over $1 Billion Won for Clients

Because We Put You First - Dedicated, Close-Knit Team

Working Together for Decades